You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. What is the 2021 Child Tax Credit Added January 31 2022 Q A2 What is the amount of the Child Tax Credit for 2021 Added January 31 2022 Q A3. For tax year 2022 the child tax credit is 2000 per child under 17 whos claimed on your tax return as a dependent Last year the credit was bumped up to 3000 per child 3600. Congress announces 70 billion bipartisan tax deal expanding child tax credit WASHINGTON Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the. File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit..

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. What is the 2021 Child Tax Credit Added January 31 2022 Q A2 What is the amount of the Child Tax Credit for 2021 Added January 31 2022 Q A3. For tax year 2022 the child tax credit is 2000 per child under 17 whos claimed on your tax return as a dependent Last year the credit was bumped up to 3000 per child 3600. Congress announces 70 billion bipartisan tax deal expanding child tax credit WASHINGTON Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the. File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit..

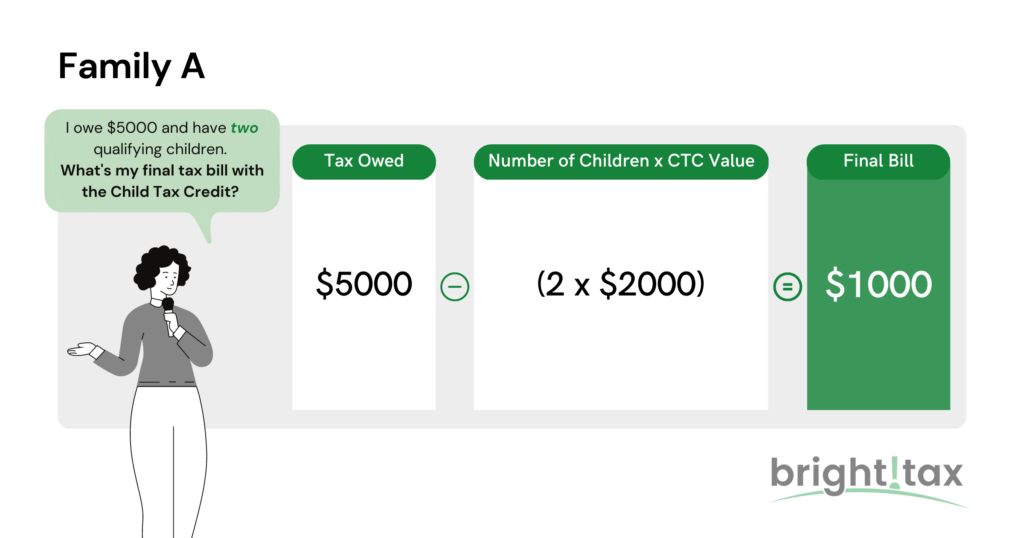

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2000. The maximum tax credit per child is 2000 for tax year 2023 The maximum credit is set to increase with inflation in 2024 and 2025. For the 2022 tax year -- which is the tax return thats due on April 18 2023 -- the child tax credit drops back down to its pre-pandemic level. How much is the child tax credit for 2023 Lets get down to dollar amounts The maximum amount for each qualifying child is 2000 with the..

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. Advance Child Tax Credit payments in 2021 Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic A General Information These updated FAQs were released to the. People with kids under the age of 17 may be eligible to claim a tax credit of up to 2000 per qualifying dependent..

Komentar